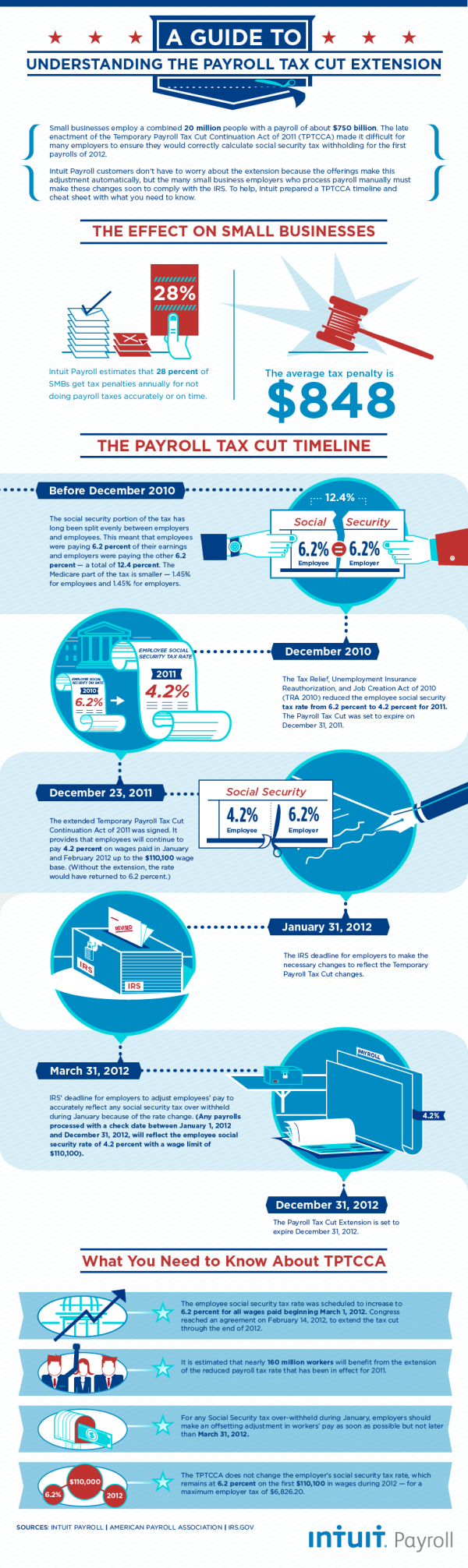

The last-minute enactment of the Temporary Payroll Tax Cut Continuation Act of 2011 (TPTCCA) in December, 011 made it difficult for many employers to ensure they would be able to correctly calculate social security tax withholding for their first payroll runs of 2012. Additionally, the extension of the payroll tax cut last week might leave small business employers wondering about any adjustments they need to make to their employees’ paychecks.

In this infographic, Intuit’s tax expert Mike D’Avolio outlines the Temporary Payroll Tax Cut Extension’s timeline, explains its impact on small businesses, and shares important IRS deadlines for employers to make the appropriate adjustments.

by Mike D'Avolio

by Mike D'Avolio